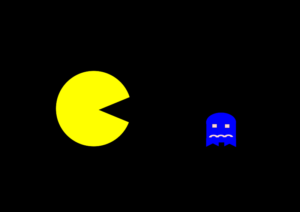

A Pac-Man defense allows a company to “gobble up” its would-be acquirer. Image Credit: Diego Moya (CC by SA-3.0)

A Pac-Man defense refers to a strategy for preventing hostile takeovers in which the target company attempts to acquire the company attempting the takeover, usually by purchasing a controlling amount of shares in the company. The term derives from the arcade game Pac-Man in which the main character can turn against his pursuers after consuming a power pellet. In a similar way, a company using a Pac-Man defense turns on its would-be acquirer by becoming the acquirer themselves.

Pac-Man defenses can be very costly, often requiring a company to sell off assets, borrow heavily, or dip into its war chest for funds. The expense can lead to losses for shareholders in future years. Pac-Man defenses can also be very distracting for management. Because of these risks, the Pac-Man defense is often seen as an extreme measure. However, there have been several notable example of its success. The first was in 1982 when Martin Marietta prevented a takeover by Bendix Corp. A more recent example occurred in 2013 when Jos. A Bank attempted to buy Men’s Warehouse. The latter company countered with its own bid and eventually bought its would-be acquirer in March 2014.

Recent Comments