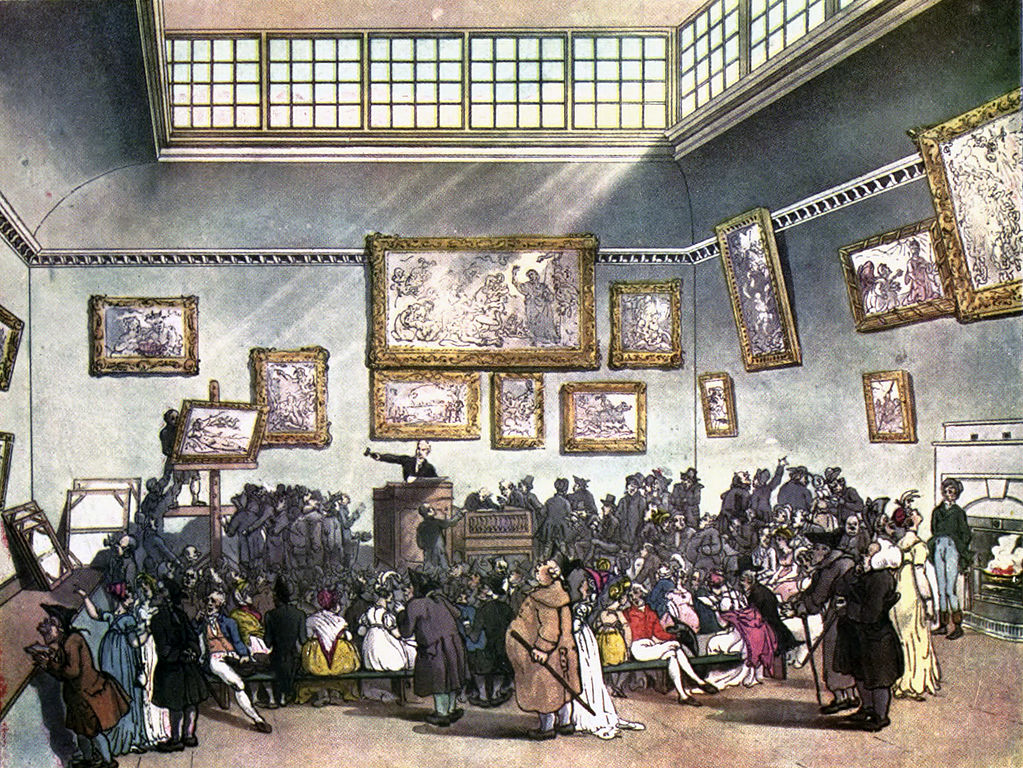

In a general economic sense, liquidity refers to how easily an asset can be bought or sold without an effect on the asset’s price. Cash is considered to be highly liquid since it can almost always be exchanged for goods and services. Other valuable items may be less liquid, or illiquid. For instance a rare painting may be valuable, but it cannot generally be directly exchanged to buy a new car. The painting must be evaluated by a professional, and auctioned or sold at a gallery, all of which takes time. If this process is abrogated, the owner will likely not receive the full value of the painting. Therefore, the painting is an illiquid asset.

Liquidity can also apply to markets. The stock market is considered very liquid since the bid price and ask price for a share are usually pretty close, meaning investors do not have to forfeit unrealized gains in order to sell quickly. On the other hand, the real estate market is considered to have low market liquidity. This is particularly true in a buyer’s market where sellers will have to give buyers deep discounts in order to sell property quickly.

Lastly, liquidity is also a term used in accounting as a measure of how easily an individual entity can sell their assets in order to pay their debts. Continuing with the example of paintings, a fine art collector would not necessarily be able to get the full value for their paintings in a short time period compared to someone with an equivalent amount of cash. Accounting liquidity is usually expressed as some type of ratio comparing liquid assets to current liabilities, meaning financial obligations that are due within one year.

Recent Comments