The Dow, or the Dow Jones Industrial Average (DJIA), is the most watched stock index on the planet. It is a price-weighted average tabulated from 30 high profile stocks traded on the NYSE and NASDAQ, including those of the world’s most influential companies. The Dow is such an important measure of market performance that both media outlets and politicians often conflate rise in the Dow with rise in the market as a whole.

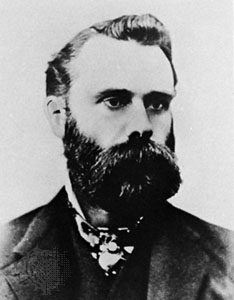

Charles Dow

The DJIA was started by American journalist Charles Dow and his business partner Edward Jones in 1896, at a time when many large mergers were taking place. The original index included just 12 companies compared to today’s 30. These original companies were almost all industrial in nature, representing the big players in oil, railroads, tobacco, cotton, gas and sugar. Only one original company, General Electric, remains on the Dow today.

The index grew to include 30 companies in 1928. Since that time there have been 51 changes in the Dow, each reflecting the growth and decline of companies over time. Major periods of change occurred in the years following the Great Depression, and during the dot com boom of the late 1990s. The most recent alteration occurring in 2015 when AT&T, Inc. was replaced by Apple.

Today’s Dow is designed to reflect the modern economy, including major forces in technology, communications, retail and entertainment. Companies as diverse as Disney, Home Depot, Wal-Mart, Visa and McDonald’s are all represented. Rather than a simple average, the Dow is now price-weighted, meaning higher shares count more than lower shares. The Dow also takes into account the many mergers and splits that have occurred over its history, which is why it can stand far higher than the sum total of its constituent stock prices.

Recent Comments