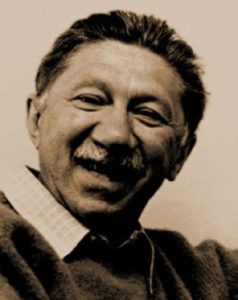

Abraham Maslow developed the concept of the “golden hammer” in 1966.

Generally speaking, a golden hammer is a singular tool or strategy used by an entity to perform many functions, to the point of excessive dependence. The concept of a golden hammer is related to psychologist Abraham Maslow’s law of the instrument. Maslow observed that as we become more familiar with a particular tool or technology, we tend to see solutions to problems in terms of that tool or technology. This reasoning led to the popular phrase “If all you have is a hammer, everything looks like a nail.”

Though often applied to research in the social sciences, the concept of a golden hammer has taken on specific meanings in the business world. In investing, it takes on the form of a trader being overly dependent on a particular analytical tool to make all decisions. It can also refer to a company that similarly only uses a particular demographic or analytical model in all its decision-making processes. In either case, excessive dependence on familiar tools can lead to inflexibility in the event of a market disruption. “Golden hammer’ can also be used in a more nuanced sense to refer to a blunt solution that is in need of refinement. Golden hammers in the above sense should not be confused with hammer patterns used in analytics, which sometimes correspond with “golden” ratios.

Recent Comments