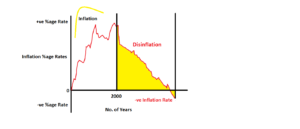

Disinflation refers to a decrease in the rate of price inflation. It is usually used by the Federal Reserve to describe marginal slowdowns in inflation over a short-term period. Unlike deflation, in which price actually lower, disinflation means a slowing rate of inflation: prices are still increasing, but at a slower rate than previous. If the inflation rate is 3% in one year, and becomes 2% the following year, than disinflation has occurred.

As in seen on the right, disinflation is a slowdown in the inflation rate over time – Image Credit: Appledoc (CC by Sa-3.0)

Disinflation is fairly common and not necessarily a sign of widespread economic slowdown. It often occurs intentionally when the central bank decides to tighten monetary policy and reduce the amount of currency available. Disinflation can also occur do to a contraction in the business cycle or a recession. Historically, the United States economy experienced regular disinflation between 1980, when the inflation rate was 14.6%, and 2015, when the inflation rate dropped to near zero. This period of disinflation was largely shaped through aggressive Fed policy, with largely positive results in both stock and bond returns. Though there was a brief threat of deflation in 2015 due to falling energy prices, the inflation rate has since risen to 2.1% as of January 2018 in a process known as reflation.

Recent Comments