The debt ceiling is a legislative limit to the amount the US government can borrow by issuing bonds. In other words, it is a congressionally-approved cap on how much national debt can be incurred by the US Treasury. The ceiling also applies to debt owed to federal government trust funds such as Social Security and Medicare. Though the debt ceiling is currently suspended, it will snap back into effect on March 1 at around $22 trillion.

For much of the country’s history, the US Congress had to directly authorize every individual debt issued. During World War I, the Second Liberty Bond Act of 1917 was established, creating a debt ceiling and giving Congress more flexibility to fund the war effort. Since then, Congress has generally raised the debt ceiling every time the limit is about to be reached. For instance, the debt ceiling was raised 74 times between 1962 and 2011.

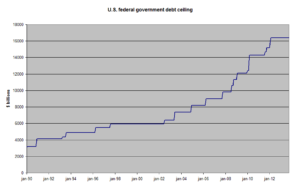

US debt ceiling from 1990-2013. Image Credit: MartinD (CC by SA-3.0)

If the debt ceiling were ever hit, the US Treasury would have to stop borrowing money. This could result in missed interest payments to bond holders and the US government going into default, raising the cost of the national debt. For this reason, there have been many political showdowns over the debt ceiling in the last few decades. The United States is unique among democratic countries in having a debt ceiling, and since 2017 there has been a bipartisan effort to pass legislation that would allow it to increase without continual congressional action.

Recent Comments