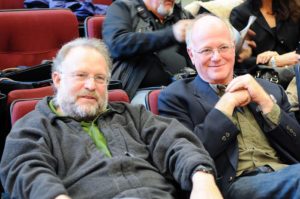

Ben Cohen and Jerry Greenfield, founder of Ben & Jerry’s Ice Cream. Image Credit: Dismas (CC by SA-2.0)

A direct public offering (DPO) is an offering in which the company offers its securities directly to the public without use of an intermediary. The normal middlemen that would be involved in an initial public offering (IPO)–such as banks, broker-dealers, and underwriters–are left out of the picture. Instead, the company self-underwrites its securities, raising money independently without the restrictions of banks and venture capital financing. The company establishes important parameters such as the offering price, the minimum investment per investor, the maximum number of securities a single investor can purchase, the settlement date, and the period in which the offering will take place.

Direct public offerings have the advantage of reducing the cost of capital. DPOs also prevent the dilution of existing shares associated with traditional IPOS, favoring owners, employees and early investors. They are usually used by small companies or companies with an established client base. An early example of a successful DPO was Ben & Jerry’s Ice Cream in 1984. Using advertisements in the local paper, the company was able to raise $750,000 in one year. A more recent example is the music streaming service Spotify in April 2018.

Recent Comments