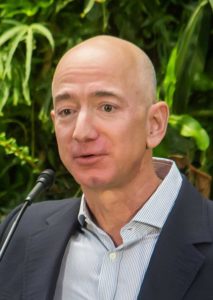

Jeff Bezos, founder of Amazon, owns 17% of the company – Image Credit: Seattle City Council (CC by 2.0)

Diluted founders is a term used within the venture capitalist community to describe the tendency for the founders of a start-up business to lose ownership of the company during the financing process. Over multiple rounds of financing through venture capital, the founder will likely cede more and more ownership of the company to the venture capitalists providing the financing. The founder dilutes their ownership in exchange for more capital to grow the business. Though their is no hard and fast rule about how much of the company the founders should hold onto, generally 15-25% is considered ideal. While it might sound like the founders end up in a weakened position, the diluted founders phenomenon generally benefits both founders and venture capitalists since the added capital is usually a necessary step for the new company to grow. For example, owning 20% of a $500 million company is much more profitable than owning all of a $10 million company.

Recent Comments